What is Martingale in the Fx? Learning how to utilize the Martingale method

Blogs

It also started to be limited inside the gambling enterprises because the people ended upwards shedding over it likely to victory. Trading lending products sells a leading risk to the investment, particularly if engaging in leveraged transactions such CFDs. It is important to keep in mind that anywhere between 74-89% away from shopping investors lose cash whenever trade CFDs. These materials is almost certainly not suitable for people, and is also crucial that you totally see the threats inside.

With the Martingale strategy, they twice as much bet in order to $cuatro to your 2nd bet. Thus, regarding the Martingale trade approach, after dropping, you will want to double their trade and you may guarantee you will earn. To make use of the brand new martingale approach effortlessly, investors need a huge account balance and become willing to withstand extreme drawdowns.

- Theoretically, the idea should be to double down on your own stock money all the time it goes down inside value.

- Margin is a hope one to agents discovered of investors dependent on the size of the newest account.

- Lowest output indicate that the fresh change dimensions has to be dramatically larger than funding to possess hold interest to be it’s successful.

- By using reputation measurements, traders can aid in reducing its exposure and avoid delivering too-big of a position.

Monetary Specialist Qualification

All content on this site is actually for educational motives merely and will not constitute economic guidance. Demand related monetary advantages in your country away from residence to get personalized advice prior to making one trade otherwise paying decisions. DayTrading.com could possibly get receive compensation from the brands otherwise functions said for the this website.

Concurrently, sets for instance the Australian dollar on the All of us dollar and you will The newest Zealand on the All of us money display initial trending services. This happens to own trend lasting more than 10 days, per every day candle try closed in the same guidance. As well as, you shouldn’t await a sharp correction once including a movement.

The new Martingale strategy may be used in combination with most other change steps, such trend following the otherwise breakout actions. However, you should cautiously think about the dangers and rehearse best risk administration processes whenever combining procedures. The techniques is also heavily depending to the which have a big membership harmony so you can endure the new growing position brands, that’s not fundamental for the majority of buyers. Pepperstone provides some risk management products such end-losings requests and bad harmony shelter.

What is the Martingale Strategy? An introduction to the widely used Playing System

This will help care for a consistent approach and https://mrbetlogin.com/super-mask/ prevents the methods out of spiraling unmanageable. These are merely a few examples of the exchange steps made use of in the forex market. People usually combine several tips otherwise personalize these to suit their trading design and chance endurance. An important is to find a strategy one aligns along with your needs and identification as the a trader. The new Martingale method is a well-known means included in the brand new international replace (Forex) or stock market. The reason why the fresh Martingale method is very popular in the fx change is basically because instead of carries, currencies hardly shed in order to zero.

Larry Connors’ RSI twenty-five & RSI 75 (They Still Performs) Change Actions Research

Even after these downsides, it is possible to improve the martingale approach that will boost your chances of succeeding. To-arrive this winnings, a trader do potentially end up being risking a countless amount of cash. When you have adequate money to burn you can rating one to 100%.

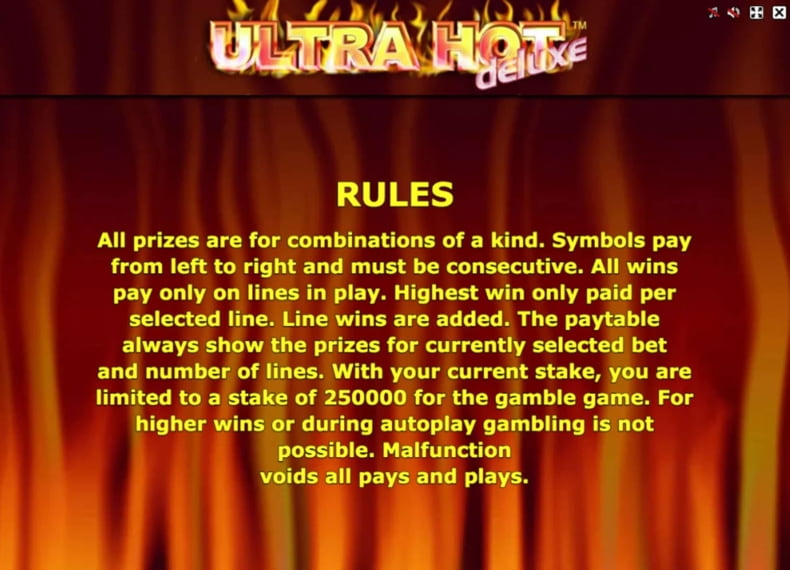

Like most gaming system, the newest Martingale Strategy has its own great amount of positives and negatives. Knowledge this type of benefits and drawbacks is very important inside the deciding whether so it approach aligns along with your gaming wants and chance threshold. Chances is actually a simple layout in the wonderful world of gaming, and the Martingale Approach capitalizes with this notion. From the considering the probabilities of specific effects, gamblers is determine how much to choice within the per bullet.

It is important for investors to closely think about the hazards and you can advantages of utilizing this tactic before making a decision even when to hire it in their own spending otherwise change points. Created in the brand new eighteenth 100 years by the Paul Pierre Levy, a great French mathematician, the fresh martingale system prioritized recovering a loss rather than making a large earnings. The machine will be based upon the thought of possibilities, convinced that after a few losings, truth be told there have to certainly become a victory. Overall, this process enables you to increase payouts throughout the happy times and you can reduce losings when chance isn’t to your benefit. To have simplicity, let’s go back to the brand new analogy we grabbed on the Martingale means. It risk dos% of your balance for every change, and when they victory, it increase the fee, however, if they slip, they work.

Concurrently, the danger try reduced during the bad conditions since the trade regularity doesn’t raise if the market value falls. Of several trading steps and you may systems within the Fx and you may Futures areas are based on some variation of your Anti-Martingale means. Frankly a large number of move trade and you will pattern following the models tend to be slightly conservative within status proportions allotment if program might have been experiencing a number of loss. In the event the then trades in addition to lead to losings, the fresh money try doubled repeatedly up until an absolute exchange are attained. The idea about this really is the ultimate effective trade usually not simply protection the earlier losses as well as generate an income.

In this case, the fresh individual you will decide to use the newest Martingale program to boost the likelihood of making a profit. Consequently should your earliest trade isn’t effective, the fresh investor often dedicate $20 next exchange (doubling the funding from the past exchange). In case your next trade is additionally unsuccessful, the brand new trader have a tendency to purchase $40 within the next exchange, and so on. While it might be good at specific circumstances, they offers a top chance of high losses. At the same time, the effectiveness of the methods minimizes with every successive dropping bet as it will get much more unrealistic that you will recoup their loss making an income as you enjoy a much deeper gap.

What is actually Martingale Position Measurements?

A simple Search can display the digital alternatives Martingale strategy is perhaps not the sole plan out here. I checklist some of the best choices lower than so you can choose which is the best for the champ’s trading package and discover the way they differ. The brand new locations might be unpredictable, therefore getting ready to accept the fresh intrinsic risks doing work in change is crucial, even with the newest Martingale means and you will candlestick pattern investigation. While you are discussing the brand new Martingale approach, they often affects the brand new investor’s mind when it’s the same as the new twice-up approach. But, ahead of i break you to notion, it should be under all of our acceptance which they each other display specific similarities. The fresh Martingale approach spends this notion because assumes on any price height one to deviates on the long-label development will eventually go back.

This market comes to risky, as well as the Martingale means can result in high losses should your trader knowledge some shedding positions. Having an excellent forex Martingale exchange means, you generally lower your mediocre entry rates each time you double your choice. Traders is hop out the forex market immediately after doubling the positions and you will reducing the average cost of money pairs, and therefore benefiting from the increased rate of exchange. Instead, they are able to opt to stay static in industry extended, as opposed to subsequent expanding its ranking, to possibly achieve high profits while the field goes up.

As well, the newest Martingale strategy is basically in accordance with the presumption your odds of success in the a trade try fifty%, that isn’t usually the way it is in the forex market. Yet not, the newest Martingale strategy is most risky and can trigger significant loss otherwise utilized very carefully. To reduce these risks, a modified Martingale approach you’ll include having fun with an alternative way for calculating what kind of cash that is committed to for each change. Therefore, if your individual bets adequate they’s totally possible he’ll ultimately wade tits. While this method will likely be great at some cases, it is very most high-risk and can result in extreme losses or even used meticulously. The strategy are an awful progression program which involves doubling the share after each and every loss, in an attempt to recover loss and you will break even.