Here are 11 alternatives to explore, each with a different emphasis in supporting your small business finances. There are several key rules of bookkeeping to keep in mind, but one of the most important is regarding debits and credits. In other words, debit is all incoming money, while credit is all outgoing money. We weighted each category equally to calculate our star ratings, and we also considered our accounting expert’s opinion and advice when ranking our top brands.

Best for Startups

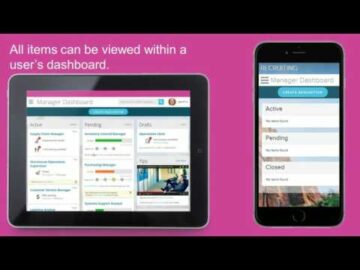

Learn more about Bench, our mission, and the dedicated team behind your financial success. Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease. Because every client and their needs vary so widely, we provide flexible, unique pricing for every client. Get in touch with one of our specialists today to get quickbooks vs excel for small business your quote or click here to get started. Clients can contact their team members during business hours from their computers or mobile app and expect a response within one business day or they can schedule a call.

Our Outsourced Accounting Services Are Inexpensive And Perfect For Small Businesses.

When you know how to read your financial statements, you can find ways to increase your profit and catch problems before they grow. A bookkeeper is not required to have any special certifications or education, while a Chartered Professional Accountant (CPA) is required to have completed a relevant certification in order to offer CPA services. The most common mistakes are mixing personal and business finances, leaving taxes to the last minute, missing out on deductions, and not retaining records for long enough. Research and financial considerations may influence how brands are displayed.

We don’t guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and contribution margin services. You won’t need any other software to work with Bench—we do everything within the platform. You can add any amount of Catch Up bookkeeping to a standard Bench plan. No matter how far behind you are (yes, even years behind), we can get you caught up quickly. You’ve heard of “spend money to make money,” but what about “spend money to save money?” That’s the case with tax deductions and you won’t want to leave any on the table.

- Accounting firms help you with your long-range planning with cash flow projections and advice on how to allocate your capital for an additional cost.

- On the other hand, most online bookkeeping services start at the $200-$400 per month range, with more advanced solutions in the $600-$800 range still being significantly cheaper than hiring a bookkeeping employee.

- The two platforms work together seamlessly, allowing you to effortlessly bill and invoice with FreshBooks, and automatically see that income reflected in your bookkeeping.

- Leaving taxes to the last second causes businesses to lose out on opportunities that come with frequent expense and revenue tracking, accurate balance sheets, accrual accounting, financial reports, and much more.

This happens when performing the functions in-house interferes with essential business growth activities. Every hour you spend on bookkeeping or accounting is one less hour spent marketing your business, building client relationships, and other business development activities. At some point, the cost to your business in terms of lost growth opportunities becomes immeasurable. Started by successful startup entrepreneurs, Pilot understands the challenges other startup entrepreneurs face in keeping the books and preparing their businesses for growth. That’s why we chose Pilot as the best accounting firm for startup businesses.

Small Business Accounting Services

With all of this in mind, the pricing of the Weekly plan is structured the same way—with costs for cash-based businesses with monthly expenses under $20,000 starting at $549 per month ($494 per month billed annually). You can use the pricing tool on the Bookkeeper360 website to test out all the pricing combinations for each plan. With all of Bookkeeper.com’s online bookkeeping services, you receive access to a web-based platform that works with QuickBooks and Microsoft Office and is customized to your business model and accounting needs. Bench offers full-service bookkeeping services for small business—with all of their plans including both a dedicated bookkeeping team and an easy-to-use software system.

Online accounting firms typically charge a monthly fee, which can help businesses to plan their expenses. For many firms, the monthly fee is based on the level of services you need. You can pay as low net working capital ratio as $150 a month for a starter package that includes day-to-day bookkeeping, account reconciliation, and financial report preparation. With some firms, you can then layer on services or choose a mid-tier package that provides for cash flow management, accounts payable and receivable, and expense tracking for $300 to $500 a month. Its bookkeeping service comes with its Enterprise plan, which costs $399 per month when billed annually. You’ll get a dedicated accountant, year-round tax advice, tax prep, bookkeeping and financial reports.

Merritt Bookkeeping automates some of the most time-consuming bookkeeping tasks — for instance, reconciling accounts, balancing books, and updating financial reports — so you can focus on running your business. It also starts at $190 a month, which is less than nearly every other provider on our list. Which can include consulting, preparing, filing and/or reporting on the accounting specifics of your business and payroll processing. Outsourced accounting services will help reduce your tax bill, increase profit margins, and scale your business.

Check out our list of the year’s best accounting software for small businesses to get started. Controller services help you oversee the accounting operations of your business. This can help your bookkeeping process, record complex journal entries, and review financial reporting to ensure accuracy. As you can see, there are a variety of bookkeeping services available on the market that can help you streamline your financial processes and relieve some of the burdens of managing your bookkeeping.